Introduction

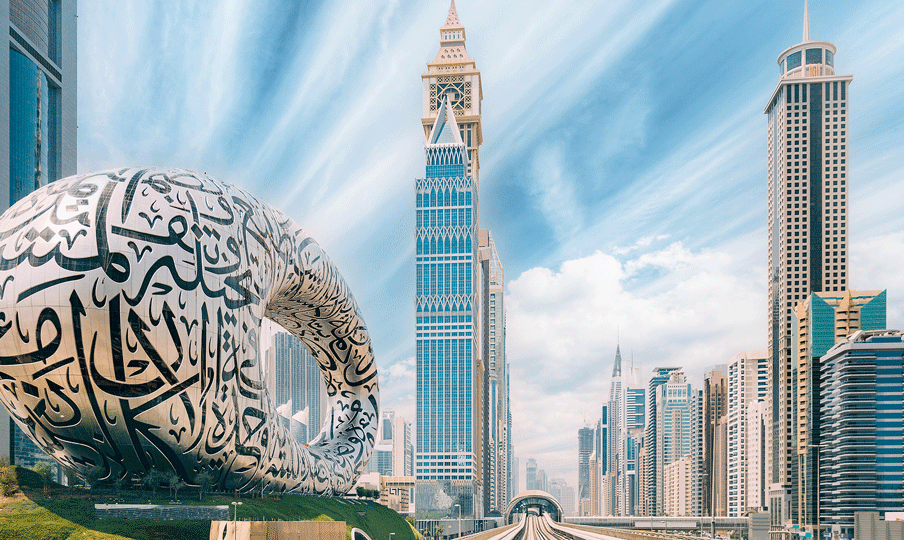

Dubai stands out as a premier destination for entrepreneurs seeking to establish and grow their businesses. Its strategic location, tax advantages, and robust infrastructure make it an attractive hub for global commerce. However, the process of setting up a business and integrating it into the financial system can be intricate. This article provides a comprehensive guide to seamless mainland business setup and efficient bank account opening in Dubai, empowering entrepreneurs to launch and manage their ventures with confidence.

Why Choose Mainland Business Setup in Dubai?

Strategic Advantages

Setting up a business on the mainland offers several strategic benefits:

- Market Access: Businesses can trade freely within the UAE and internationally without restrictions.

- Government Contracts: Mainland companies are eligible to bid for lucrative government contracts.

- Location Flexibility: Businesses can establish offices in prime locations across Dubai, enhancing visibility and accessibility.

Legal Structures for Mainland Businesses

When opting for a mainland business setup, entrepreneurs can choose from various legal structures, including:

- Sole Proprietorship: Owned and operated by a single individual.

- Civil Company: Suitable for professionals in fields such as law, medicine, and engineering.

- Limited Liability Company (LLC): A popular choice offering limited liability protection and flexibility in business activities.

- Branch of a Foreign Company: Allows foreign companies to establish a presence in Dubai while retaining their original legal identity.

Steps to Mainland Business Setup

Step 1: Determine Business Activity

The first step is to identify the business activity you wish to undertake. This will influence the type of license required and the relevant government authorities you will interact with.

Step 2: Choose a Trade Name

Selecting a unique trade name that reflects your business activity is crucial. The name must comply with the UAE’s naming conventions and be approved by the Department of Economic Development (DED).

Step 3: Obtain Initial Approvals

Depending on your business activity, you may need initial approvals from various government departments. These approvals ensure that your business complies with local regulations and industry standards.

Step 4: Draft the Memorandum of Association (MOA)

For LLCs and certain other business types, drafting the MOA is essential. This document outlines the ownership structure, capital distribution, and operational framework of the business.

Step 5: Lease Office Space

Leasing a physical office space is mandatory for mainland businesses. The size and location of the office should align with the business activities and regulatory requirements.

Step 6: Submit License Application

Once all the necessary documents and approvals are in place, submit your license application to the DED. The type of license (commercial, industrial, or professional) will depend on your business activity.

Step 7: Final Approvals and License Issuance

After the application is reviewed and approved, you will receive your business license, allowing you to commence operations.

Importance of Efficient Bank Account Opening in Dubai

Why a Business Bank Account is Essential

A dedicated business bank account is crucial for:

- Financial Management: Separating personal and business finances ensures accurate accounting and financial management.

- Regulatory Compliance: Maintaining proper records and complying with financial regulations is essential for legal compliance.

- Facilitating Transactions: A business bank account simplifies transactions, payments, and receipts, enhancing operational efficiency.

Choosing the Right Bank

When selecting a bank for your business account in Dubai, consider the following factors:

- Reputation and Reliability: Opt for banks with a strong reputation and track record of reliability.

- Range of Services: Ensure the bank offers comprehensive services, including online banking, trade finance, and foreign exchange.

- Fee Structure: Compare fees and charges to find a bank that offers competitive rates and minimal hidden costs.

- Customer Support: Choose a bank known for excellent customer support to address any issues promptly.

Requirements for Bank Account Opening

The typical requirements for opening a business bank account in Dubai include:

- Trade License: A copy of your valid trade license.

- Memorandum of Association: A copy of the MOA.

- Shareholder Information: Details and passport copies of shareholders and directors.

- Proof of Address: Utility bills or tenancy contracts as proof of the business address.

- Business Plan: Some banks may require a business plan outlining the nature and scope of the business.

Steps to Open a Business Bank Account

- Prepare Documentation: Gather all required documents, including the trade license, MOA, shareholder information, and proof of address.

- Select a Bank: Choose a bank that meets your business needs and offers favorable terms.

- Submit Application: Complete the bank’s application form and submit it along with the required documents.

- Compliance Checks: The bank will conduct due diligence and compliance checks to verify the information provided.

- Account Approval: Once approved, you will receive the account details and can start using the account for business transactions.

Benefits of a Seamless Integration

Enhanced Operational Efficiency

A streamlined business setup and banking process ensure that your business can commence operations quickly and efficiently, minimizing downtime and operational delays.

Financial Stability and Growth

Having a dedicated business bank account facilitates better financial management, helping you track expenses, manage cash flow, and make informed financial decisions, contributing to long-term stability and growth.

Compliance and Risk Management

Properly established business structures and financial accounts help ensure compliance with local regulations, reducing the risk of legal issues and financial penalties.

Conclusion

Establishing a mainland business in Dubai offers numerous advantages, including market access, government contract eligibility, and strategic location flexibility. Partnering with a reputable business setup company can simplify the process, ensuring all legal and regulatory requirements are met. Additionally, opening a business bank account in Dubai is essential for efficient financial management and operational success. By following the steps outlined in this guide, entrepreneurs can transform their vision into reality, launching and managing their businesses with confidence and ease in one of the world’s most dynamic business hubs.